South Carolina offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

South Carolina Government

State House

1100 Gervais Street

Columbia, South Carolina 29201

Phone: (803) 734-2100

Fax: (803) 734-5167

Monday – Friday, 9:00 a.m. – 5:00 p.m.

Saturday, 10:00 a.m. – 4:00 p.m.

Santee Cooper

1703 N. Oak St.

Myrtle Beach, SC 29577

(800) 804-7424 ext. 3910

(843) 761-8000

[email protected]

[email protected]

[email protected]

South Carolina Energy Office

1401 Main Street, Suite 900

Columbia, SC 29201

(803) 737-0800

[email protected]

Monday – Friday, 9:00 a.m. – 5:00 p.m.

Charleston Weather Bureau

5777 South Aviation Avenue

North Charleston, SC 29406

(843) 747-5860

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2021- | 100% property tax exemption | Individuals who install equipment with 20 kW-AC or less |

| 2006- | Personal tax credit amounting to 25% of eligible costs, capped at $3,500 or 50% of tax liability (whichever is less) per tax year; excess credits may be carried forward for up to 10 years | Individuals who purchase and install solar energy systems that are certified by SRCC or similar entities endorsed by the South Carolina Energy Office |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

South Carolina Clean Energy

Energy-Efficient Home Design

Home Energy Rebate Programs

Energy Saver Tool

Electric Vehicle Stakeholder Initiative (EVSI)

Renewable Energy

Energy Resilience

Clean Transportation Tool

Power Outage Map

SC Department of Environmental Services

2600 Bull St.

Columbia, SC 29201

Monday – Friday, 9:00 a.m. – 5:00 p.m.

(803) 898-3432

South Carolina Solar Energy Overview

Since 2020, solar capacity in South Carolina has grown by over 140%.6 When you also consider that the average household in South Carolina uses around 1,081 kWh of electricity every month while the national average is 893 kWh,2,15 you realize that installing solar is now not just a good idea, but also a smart investment.

South Carolina experiences a lot of sunny days throughout the year, around 216 sunny days to be precise.1

This makes the Palmetto State a prime location for homeowners who want to take charge of their electricity bills and save hundreds of dollars every year through solar power and South Carolina solar incentives, and the best part is that enrollment is simple.

What’s more, with some generous solar incentives, tax credits, rebates, and net metering, you can install solar panels on your South Carolina home for less.

Are you ready to harness the power of the sun? Do you want to gain energy independence, reduce your carbon footprint, and save big on utility bills?

Keep reading to find out:

- What solar credits and rebates are available to you in South Carolina

- How much you could potentially save with solar incentives

- Everything you need to know to go solar for less in SC

What Solar Credits Are Available in South Carolina?

South Carolina’s solar market currently ranks 14th in the country according to the Solar Energy Industries Association.17

This means it is one of the best states right now where residents can take advantage of the benefits of switching to solar energy.

South Carolina offers a power-packed combination of federal, state, and local solar incentives. These credits and rebates can drastically cut the cost of going solar.

Here is an overview of the main programs you can use to reduce your out-of-pocket expense of going solar.

The main solar perks you can tap into include:

- Federal Solar Tax Credit: Recoup 30% of your solar installation costs back as an income tax credit until 2032.

- SC Solar Energy Tax Credit: Save 25% on solar installation with this state tax rebate of up to $3,500.

- Net Metering: Earn bill credits from your utility for the excess solar electricity your solar panels generate.

- Local Utility Rebates: Get extra incentives from your local utility company

Could you use some extra cash in your pocket? Who couldn’t? Read on to understand how you can claim these solar incentives for major savings.

Federal Solar Credit Overview

First up, the federal solar Investment Tax Credit (ITC) is by far the biggest nationwide solar incentive and your ticket to slashing 30% right off your South Carolina solar installation costs.14

Sound too good to be true? It is very real and straightforward.

The federal tax credit was first developed through the Energy Policy Act of 2005 and was initially meant to last for only two years.12 However, owing to its success, it has continuously been extended.

In 2022, through the passage of the Inflation Reduction Act,4 it was further expanded and extended which means you have another decade of solar savings to take advantage of.13

The federal government offers this credit to encourage Americans in all states to adopt renewable energy. Therefore, you might as well take advantage, right?

Here are key things to know about claiming the federal solar tax credit:

- It reduces your income tax liability. The federal ITC allows you to claim 30% of your solar costs as a direct credit against your tax burden for the year in which your solar system becomes operational.

- The 30% tax credit runs through 2032. It is then set to reduce to 26% for solar systems installed in 2022 and then to 22% in 2034 before expiring in 2035.

- It covers the total cost of installing a home solar system. This includes the cost of purchasing photovoltaic (PV) systems, solar water heating, battery storage, permitting costs, and installation charges.

To be eligible for the ITC, you need to meet the following criteria.

- You need to have installed a residential solar system before 2035

- You have installed the solar system in a residential location. This location does not need to be your primary residence.

It can be your main home or vacation home, but not a rental property. - You own the solar system either by paying for it with cash upfront or by taking a solar loan. If you are leasing the solar panels or you are under a power purchasing agreement, you are not eligible to claim the credit.

How To Claim the Federal Solar Investment Tax Credit (ITC) in South Carolina

You can claim the credit when filing your taxes for the year by submitting IRS Form 5695 along with documentation of your total solar installation costs.3 This includes costs incurred on parts, permitting fees, labor, taxes, and anything related to the installation of your solar system.

You will need to submit all these invoices, receipts, and other paperwork as proof when claiming the credit.

One common question many people ask is, “How does the solar tax credit work if I don’t owe taxes?”

If your tax credit exceeds your outstanding tax obligations for the year, the remaining credit is rolled over for use in the next tax season. You can roll over this credit year-to-year for up to 5 years until it is finished

With the average cost of a solar system for a typical home in South Carolina being around $29,920, using the federal tax credit will save you $8,976. Not too shabby!

Although this incentive will require you to handle some paperwork, the reward is well worth the effort.

State and Local Solar Incentives in South Carolina

In addition to the federal credit, you can capitalize on other generous state and local solar incentives to make it easier for you to go solar.

South Carolina Solar Energy Tax Credit

As a South Carolina resident looking to switch to solar power, saying you are lucky is an understatement.

Why? South Carolina is among the very few states that offer statewide solar incentives.

Through the passing of this South Carolina solar bill,11 you can claim a whopping 25% of the total installation cost of your solar system as a tax credit. Imagine how much money you will end up saving when you combine the 25% state solar credit with the 30% federal solar credit.

Most solar experts also agree that this is one of the most lucrative state tax credits in the country at the moment.

Say you have the average solar power for house energy requirements in South Carolina at a total cost of $29,920, the state solar credit allows you to reduce your state income tax by a whopping $7,480. Yes, read that again.

And that’s not all, combine it with the ITC and you have a net savings of $16,456. Saying you are lucky is indeed an understatement.

That said, this credit has a ceiling: $35,000 or 50% of the money you owe whichever is lower. You also need to apply for this credit in the year during which your solar panels are installed.

Additionally, the South Carolina state tax credit bill limits the maximum amount that can reflect on your tax credit every year to $3,500.

Are you impressed? Wait, there is more.

You may be wondering, “How long do solar credits last in South Carolina?”

Currently, this credit does not have an expiration date! Additionally, you can roll over any remaining credit on top of the yearly $3,500 year-to-year for up to 10 years; double the ITC timeframe.

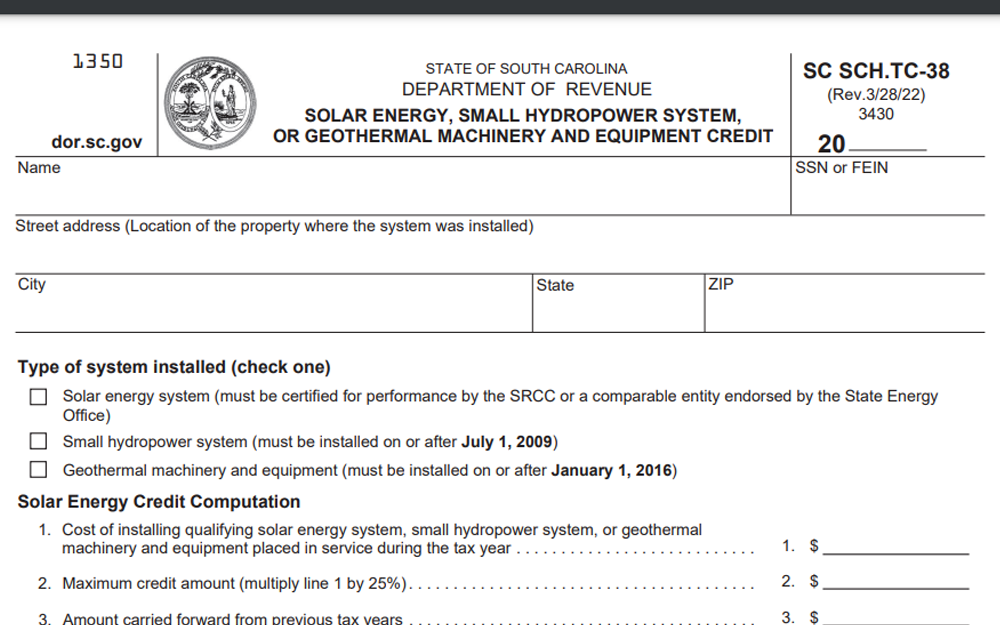

How To Claim the South Carolina Solar Energy Tax Credit

As is the case with the federal tax credit, the SC solar energy tax credit is designed to help you afford solar power installation. The credit goes towards reducing your tax liability.

To claim this rebate, you need to submit the SCH.TC-38 tax form and supporting documentation with your SC tax return.7

The supporting documentation includes solar system design and permits as well as receipts and invoices showing your total solar installation cost.

When you combine the SC solar tax credit and the ITC, you essentially wipe out 55% of the total cost of switching to solar. Isn’t that amazing?

Renewable Energy Property Tax Exemption

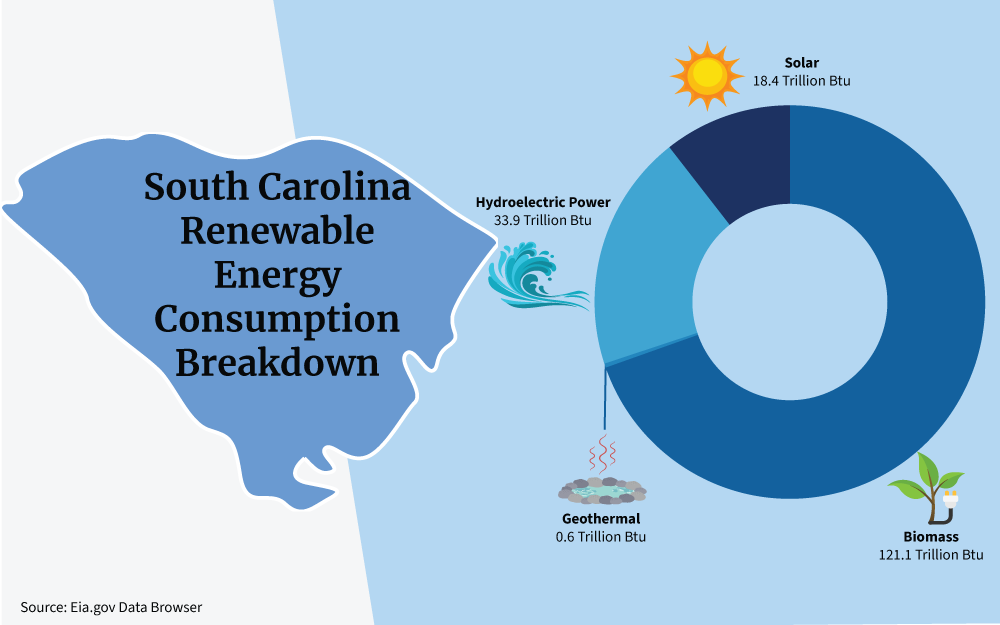

Around 7% of South Carolina’s state-generated electricity comes from renewable sources of power, primarily hydroelectric power, biomass, and solar.16

That being said, the state continues to ramp up access to programs that would encourage residents to make the switch to clean energy.

The Palmetto state recently amended a bill that gives you a 100% tax exemption if you install a residential solar system in your home with a max capacity of 20 kW.10

As is the case with other home improvement projects, installing a solar system in your home is bound to raise its value by around 4% based on national averages.

Effectively, this should raise your property taxes; but no. Not in South Carolina.

You will not need to pay a cent more in property taxes as a result of installing solar in your home. What’s more, this exemption also applies to leased and third-party solar systems.

The best part: this incentive applies automatically based on the assessed value of your home; you do not need any paperwork to claim it.

Local Solar Incentive Programs

In South Carolina, you also have access to various local solar incentives championed by local utility companies, not-for-profit organizations, and financing organizations.

If you live in the Santee Cooper region, you can get more incentives for going solar. One particular utility-led rebate program allows you to get $0.95 back per watt of solar power capacity installed on your home, up to $5,700 max for a system up to 20 kW.18

To claim this rebate, you will need to apply through the particular utility company and use an approved electrician for solar or a NABCEP-certified installer. You can find the list of qualified installers on their website.

The application form is simple and your contractor will help ensure that you get the full rebate amount.

What if you are struggling to raise all the money you need for a solar installation? Well, it may be time to consider a solar loan.

Several organizations will offer you a solar loan, allowing you to go solar with zero to minimal upfront cost. What’s more, you can still claim the federal and state tax credit provided the solar loan is not attached to a power purchasing agreement with a utility company.

Between the federal solar tax credit, state tax credit, property tax exemption, utility rebates, or a solar loan, you could potentially wipe out more than half the cost of solar panels in South Carolina!

How Can I Apply for Solar Tax Credits in South Carolina?

If you’re itching to go solar but have been waiting for the perfect time, the time is now! Here are tips for securing South Carolina’s lucrative solar incentives:

State Solar Tax Credit

Here are the steps you can follow to apply for state solar tax credit:

Step 1: Complete your solar installation and keep all receipts and invoices.

Step 2: Fill out form SCH.TC-38 listing your solar equipment costs.

Step 3: Submit it with your SC tax return to get 25% back (up to $3,500 annually).

Federal Solar Tax Credit

Below are the steps you can follow to apply for federal solar tax credit:

Step 1: Maintain detailed records of all your solar-related expenses.

Step 2: Complete IRS Form 5695 with your qualifying equipment/installation costs.

Step 3: File with your federal taxes to claim the 30% credit.

Net Metering

Below are the steps for net metering application:

Step 1: Contact your utility to apply for interconnection.

Step 2: Have your solar installer help with the application process.

Step 3: Sign an agreement to enroll in the net metering program.

What Materials and Parts Do You Need for Solar Panel Systems?

Going solar is a big investment; it takes more than just slapping a PV panel on your roof. A complete solar system requires several key components:

Solar Panels

What an engine is to a car, solar panels are to a solar power system. As such, they account for approximately 40% of the total cost of the solar system.

But what does solar panels do, exactly?

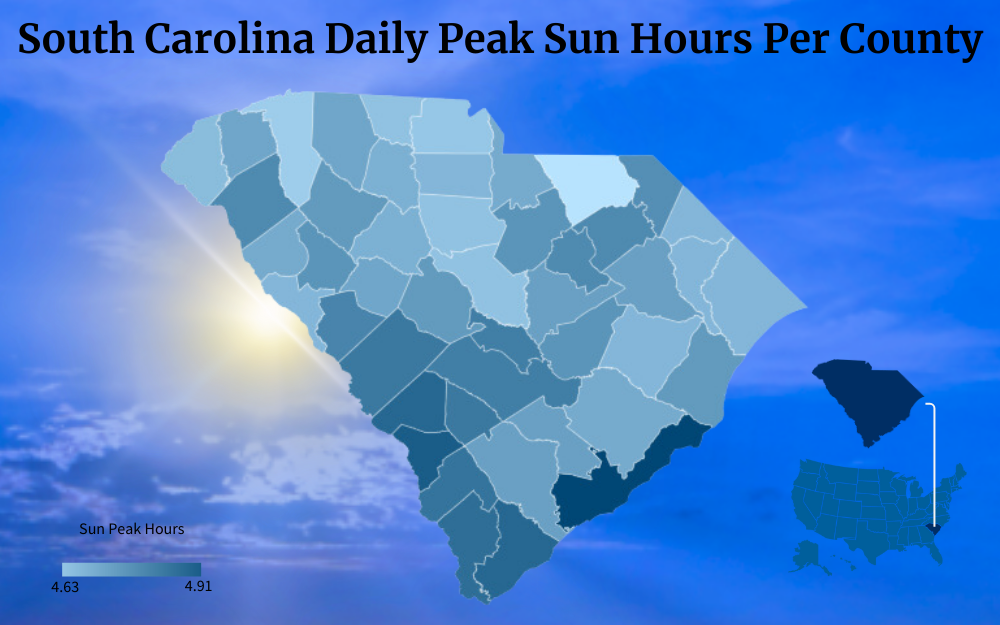

These panels collect sunshine and convert it into usable electricity. Thus, when deciding to go solar, it is always helpful to know your location’s peak sun hours or, in simpler terms, how much sunlight the area where you will be installing your system receives.

Monocrystalline silicon is the most efficient panel type for residential use.

You can expect to pay $2 to $4 per watt depending on the brand, efficiency rating, and warranty of solar panels USA has to offer.

Inverters

An inverter converts the DC electricity from your solar panels into usable AC power for your home.

Central inverters are more affordable while microinverters on each panel provide optimized performance but will cost you more. Plan to spend $0.20 to $0.40 per watt of your system size on a quality inverter.

Racking and Mounting

Roof mounts, rails, and flashing kits secure your solar array to your roof. Flush mounts tend to be used on shingle roofs while rail mounts help in elevating the panels.

The cost of this equipment ranges from $1 to $3 per watt with labor, or $1,000 to $2,000 for a standard residential system on a roof with asphalt shingles.

Electrical Components

You also need cables, conduits, junction boxes, combiners, and disconnect switches to safely integrate your solar panels with your home’s electrical system. These components add $1,000 to $2,000 in costs for a typical home solar installation.

Monitoring System

Although optional, a monitoring system allows you to track system performance and savings. Basic monitoring starts at around $500 while robust panel-level monitoring can cost $1,500 or more.

When all is said and done, a standard 6 kW solar system will cost you around $18,000 to $22,000 in South Carolina before incentives kick in which is around $3.45 per watt.

With the 30% ITC, the cost comes down to $2.66 per watt which is lower than the national average of $2.85 per watt.

Note that, as a South Carolina resident, you will need a bigger solar system capacity than most states due to higher air conditioning requirements.

Solar Installation Calculator Costs

Do you want to estimate your solar power potential and the cost savings for your SC home? A good solar calculator makes this easy.8

Just provide details like:

- Your location: Electricity rates vary across South Carolina.

- System size needed: Based on your average monthly power consumption.

- Roof layout: Pitched roofs often cost less than flat roofs.

- Sun exposure: South-facing roofs maximize solar production.

- Electricity costs: Your current utility rate impacts savings.

A quality solar calculator will then use your inputs to provide you with valuable information about solar panels including:

- Your total solar array size required

- Your expected annual electricity generation

- Your potential utility bill savings with solar in SC

Running the numbers will give you an idea of your solar energy ROI. You can also tweak variables like equipment brands and incentives to optimize payback.

Does the investment pencil out? That’s what a solar calculator will help you uncover.

Net Metering Explained

One other essential program you need to be aware of as a new solar owner is net metering.

South Carolina requires the state’s major investor-owned utilities to offer net metering programs. Net metering (NEM) allows you to earn energy bill credits for sending the excess solar power generated by your solar panels back to the grid.9

In essence, it is a billing mechanism that allows you to maximize your solar system savings.

Here is how it works:

- Your solar panels produce electricity first and foremost for your home’s use.

- When you generate more than you need, the surplus gets fed into the grid.

- Your utility company then gives you energy credits on your bill.

- On days your solar panels fall short, those credits balance out your usage.

- You then only pay the utility company for your “net” consumption.

To enroll, you will need to submit an interconnection application to your utility provider. Your utility provider will then install a bidirectional net meter to track your power usage and production.

Any net excess each month rolls over to help pay your future bills. Over time, net metering can drastically shrink how much you pay for electricity from the grid.

In most cases, your solar installer will coordinate all the net metering registration paperwork during system interconnection.

Contractor Requirements for Home Solar System Installation (Choosing the Right SC Solar Installer)

Finding the perfect solar installation pro is key to an incentive-maximizing, money-saving solar experience.

Be sure to check:

- Experience: Established local companies have more know-how.

- Training: NABCEP certification is ideal.5

- Insurance: Fully licensed, bonded, and insured is a must.

- Reviews: Talk to past customers and read feedback online.

- Pricing: Get quotes from 3 to 5 installers for honest cost comparisons.

- Offerings: Look for financing flexibility, battery storage options, net metering expertise, and more.

Vetting your solar options, especially your providers, carefully ensures your ideal solar setup with a trusted expert.

More South Carolina Solar Facts You Need To Know

Here are some more solar energy facts in South Carolina that may be beneficial in your journey of switching to clean energy:

- Solar panels’ environmental impact is low to none. They do not produce greenhouse gases and have a very low carbon footprint.

- The average lifespan of a solar PV system is around 25-30 years, but it ultimately depends on the system quality and panel management over time.

- At their end of life, you should consider options for proper disposal of solar panels like having them recycled by authorized institutions in order to mitigate waste.

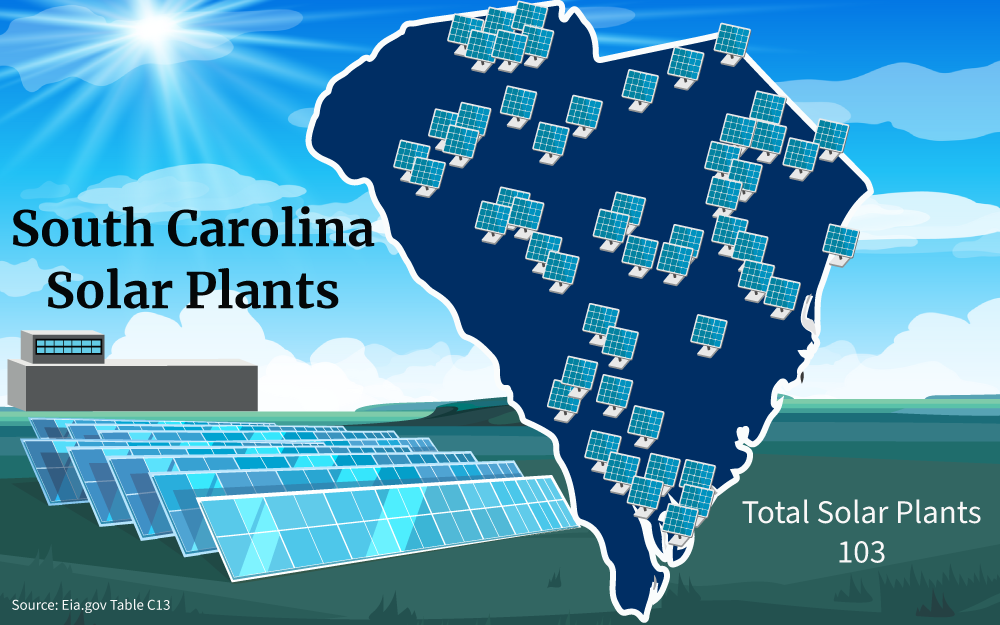

- South Carolina currently has 103 solar plants across the state that help answer the electricity needs of the region.

Now is a fantastic time to go solar in South Carolina!

With abundant sunshine, sky-high electric bills, and generous incentives, South Carolina is helping you eliminate the most common problems with solar energy: mainly, the cost of going solar.

Tax credits can reduce your purchase expenditure by up to 55%, and net metering provides ongoing utility bill savings.

Additionally, South Carolina solar incentives will likely not last forever. Getting enrolled in net metering now ensures you reap the maximum benefits.

And the sooner you switch to solar, the more you’ll save long-term on utility bills while slashing your carbon footprint. Take control of your energy future by going solar this year!

Install your desired solar system, claim your federal tax credit, pile on state tax rebates, and maximize net metering credits for the best ROI. Then sit back and watch your energy savings grow while you bask in green electricity from the warmth of the Carolina sun.

Take the leap and go solar for less with the help of South Carolina solar incentives; you won’t regret it!

Frequent Questions About South Carolina Solar Incentives

Can You Really Get Free Solar Panels in South Carolina?

While no programs offer 100% free solar, the combination of credits and rebates can reduce your out-of-pocket investment dramatically. Beware of shady “free solar” scams like “free solar panels for seniors” that target the elderly; if it sounds too good to be true, it probably is.

What Is South Carolina's State Solar Tax Credit Amount for 2023?

The South Carolina solar tax credit lets homeowners claim back 25% of the total costs, up to $3,500 maximum per year. This can be claimed each tax year until your credit is exhausted or up to 10 years.

Can My HOA Ban Solar Panels in SC?

Unfortunately, yes, HOAs in South Carolina can prohibit or restrict solar panel installations. As such, it is best to check your HOA guidelines before signing any solar contract or putting down a deposit on a solar; make sure you have their approval in writing just in case.

References

1Current Results Publishing Ltd. (2023). Days of Sunshine Per Year in South Carolina. Current Results. Retrieved September 14, 2023, from <https://www.currentresults.com/Weather/South-Carolina/annual-days-of-sunshine.php>

2Electricity Local. (2023). South Carolina Electricity Rates & Consumption. Electricity Local. Retrieved September 14, 2023, from <https://www.electricitylocal.com/states/south-carolina/>

3Internal Revenue Service. (2022). Residential Energy Credits. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

4Internal Revenue Service. (2023, September 12). Inflation Reduction Act of 2022. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/inflation-reduction-act-of-2022>

5North American Board of Certified Energy Practitioners. (2023). Certifications. NABCEP. Retrieved September 14, 2023, from <https://www.nabcep.org/certifications/>

6Solar Energy Industries Association. (2023). South Carolina Solar. Solar Energy Industries Association. Retrieved September 14, 2023, from <https://www.seia.org/state-solar-policy/south-carolina-solar>

7South Carolina Department of Revenue. (2022, March 28). SC SCH.TC-38. South Carolina Department of Revenue. Retrieved September 14, 2023, from <https://dor.sc.gov/forms-site/Forms/TC38.pdf>

8South Carolina Energy Office. (2023). Financing a System. SOLAR.SC.GOV. Retrieved September 14, 2023, from <https://solar.sc.gov/financing-system>

9South Carolina Energy Office. (2023). Tax Credits, Incentives, and Net Metering. SOLAR.SC.GOV. Retrieved September 14, 2023, from <https://solar.sc.gov/financing-system/tax-credits-incentives-and-net-metering>

10South Carolina Legislative Services Agency. (2023, March 22). Bill S. 653. South Carolina Legislature. Retrieved September 14, 2023, from <https://www.scstatehouse.gov/sess125_2023-2024/bills/653.htm>

11South Carolina Legislative Services Agency. (2023, September 8). Bill H. 3106. South Carolina Legislature. Retrieved September 14, 2023, from <https://www.scstatehouse.gov/sess125_2023-2024/bills/3106.htm>

12U.S. Department of Energy. (2005, August 8). Energy Policy Act of 2005. Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/articles/energy-policy-act-2005>

13U.S. Department of Energy. (2022, September 8). Solar Investment Tax Credit: What Changed? Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/eere/solar/articles/solar-investment-tax-credit-what-changed>

14U.S. Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.gov. Retrieved September 14, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

15U.S. Energy Information Administration. (2019, May 9). Use of energy explained: Energy use in homes. U.S. Energy Information Administration. Retrieved September 14, 2023, from <https://www.eia.gov/energyexplained/use-of-energy/electricity-use-in-homes.php>

16U.S. Energy Information Administration. (2023, January 19). South Carolina State Profile and Energy Estimates. EIA. Retrieved September 14, 2023, from <https://www.eia.gov/state/analysis.php?sid=SC#72>

17Solar Energy Industries Association. (2023). South Carolina Solar. Solar Energy Industries Association. Retrieved September 14, 2023, from <https://www.seia.org/state-solar-policy/south-carolina-solar>

18Santee Cooper. (2023). Enjoy solar power without buying solar panels. Santee Cooper. Retrieved September 15, 2023, from <https://www.santeecooper.com/programs-incentives/empowersolar/solar-share/>

19Solar panels at City Roots LLC, in Columbia, S.C Photo by USDA Photo by Lance Cheung. / Public Domain. Cropped, Resized and Changed Format. From Flickr <https://www.flickr.com/photos/usdagov/52302393783>

20Solar panels on roof at City Roots LLC, in Columbia, S.C Photo by USDA Photo by Lance Cheung. / Public Domain. Cropped, Resized and Changed Format. From Flickr <https://www.flickr.com/photos/usdagov/52302877540/>